How to Budget Can Be Tricky.

How much will we need to retire is the million-dollar question. Most folks try to calculate it based on the lifestyle they wish to have in retirement and how much they believe that will cost, and save towards that number.

But what about inflation?

When planning for retirement, it’s crucial to consider the impact of inflation on your savings and income. Inflation refers to the gradual increase in the prices of goods and services over time, which erodes the purchasing power of money. To account for inflation in retirement planning, you’ll need to calculate how it will affect your expenses and income during your retirement years.

One way to calculate inflation when planning for retirement is to use the Consumer Price Index (CPI), which measures changes in the cost of a basket of goods and services commonly purchased by households. By examining historical CPI data, you can estimate the average annual inflation rate and use it to project future increases in living expenses. For example, if the historical average inflation rate is 3% per year, you can assume that your expenses will increase by approximately 3% annually during retirement.

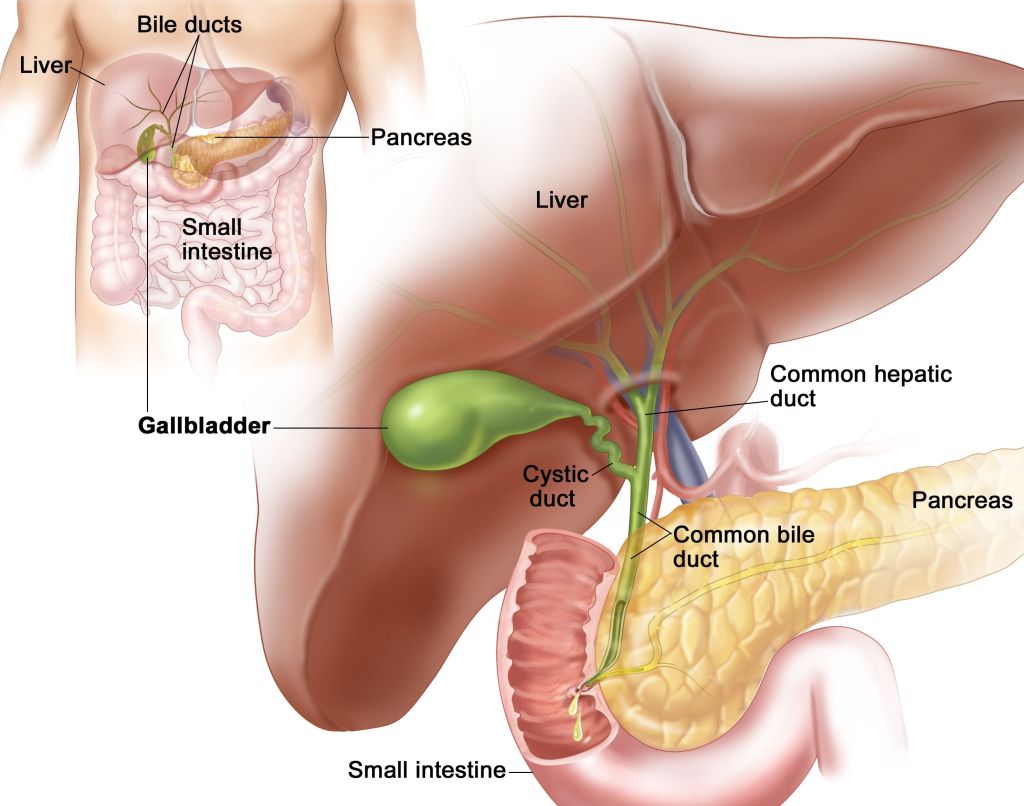

Medical Expenses

Another method to calculate inflation in retirement planning is to consider specific categories of expenses that may be subject to higher inflation rates than the overall CPI. For instance, healthcare costs tend to rise at a faster pace than general inflation, so it’s essential to factor in potential increases in medical expenses when estimating your retirement budget. Similarly, housing costs, especially property taxes and maintenance expenses, may also outpace general inflation rates in certain regions.

Additionally, when calculating inflation for retirement planning, adjusting your expected investment returns is essential. While certain investment vehicles such as stocks may provide returns that outpace inflation over the long term, others like bonds may offer more modest returns that barely keep pace with inflation. By incorporating an inflation-adjusted rate of return into your retirement portfolio projections, you can ensure that your investments will continue to generate sufficient income to cover your expenses throughout retirement.

Adjust Retirement Plans Periodically

Finally, it’s crucial to revisit and adjust your retirement plan periodically to account for changes in inflation rates and other factors that may impact your financial situation. As you approach retirement and throughout your retirement years, regularly reviewing your budget, investment portfolio, and financial goals will help you stay on track to achieve a secure and comfortable retirement despite the effects of inflation. Working with a financial advisor can also provide valuable guidance and expertise in navigating the complexities of retirement planning in an inflationary environment.